PathoQuest closes up to €15 million Series B financing round led by growth investor SHS Capital

This funding round allocated in tranches will strengthen PathoQuest’s position as a leading NGS-based biosafety CRO for the biopharmaceutical industry.

Paris, FRANCE, Tübingen, GERMANY – November 9th, 2021 – PathoQuest, a pioneer in the quality control of biologics using Next-Generation Sequencing (NGS), today announced the closing of a financing round up to €15M. This funding leverages the NGS technology in a proprietary approach to assess the viral safety and genetic characterization of biologics. It will support the development of PathoQuest’s US site (Wayne, PA), the expansion of the portfolio of NGS-based quality control (QC) tests, and will accelerate its growth and market share worldwide.

The funding round is led by new investors, SHS Capital (Germany), followed by Turenne Capital/SHAM (France) and a US Family Office to reinforce the support from existing shareholders, Kurma Partners (France), Verve ventures (Switzerland), Eurazeo (France), Aurinvest (France), and a strategic partner, Charles River Laboratories (USA).

“We are pleased to acquire our first investment in a French company with the participation in PathoQuest. This expands our portfolio of promising European healthcare champions. With its innovative NGS-based approach for the biosafety of biologics, PathoQuest will help biopharmaceutical companies in their quest to deliver advanced therapy medicinal products and vaccines more safely and more rapidly than ever to patients,” stated Sascha Alilovic, Managing Partner at SHS Capital. “To meet the leading market needs, PathoQuest is also expanding globally with a state-of-the-art facility located in Wayne, Pennsylvania, and is broadening its portfolio of NGS-based quality control solutions for the biosafety of biologics.”

“We are pleased to complete this financing round since it enables PathoQuest to further establish its position as a leader of NGS-based quality control of cell and gene therapies, vaccines and other biologics,” commented Jean-Francois Brepson, PathoQuest’s CEO. “This funding will support the company’s fast commercial development to provide faster and safer testing to replace traditional methods including animal testing, at a Good Manufacturing Practice grade.”

Life Sciences investment firm Fraser Finance (fraserfinance.com) acted as an exclusive financial advisor to PathoQuest for this transaction. Willy Mathot Avocat at Pact Avocats (pactavocats.com) acted as legal advisor to PathoQuest. SHS was advised on the transaction by Jérôme Chapron, from the law firm Chammas & Marcheteau. Turenne/SHAM was advised by Jérôme Chapron & Jeremie Lolmede from the law firm Chammas & Marcheteau, Marc Olivier Bévierre & Anne Moore from Cepton and Julien Trelhu from Repère group.

About PathoQuest

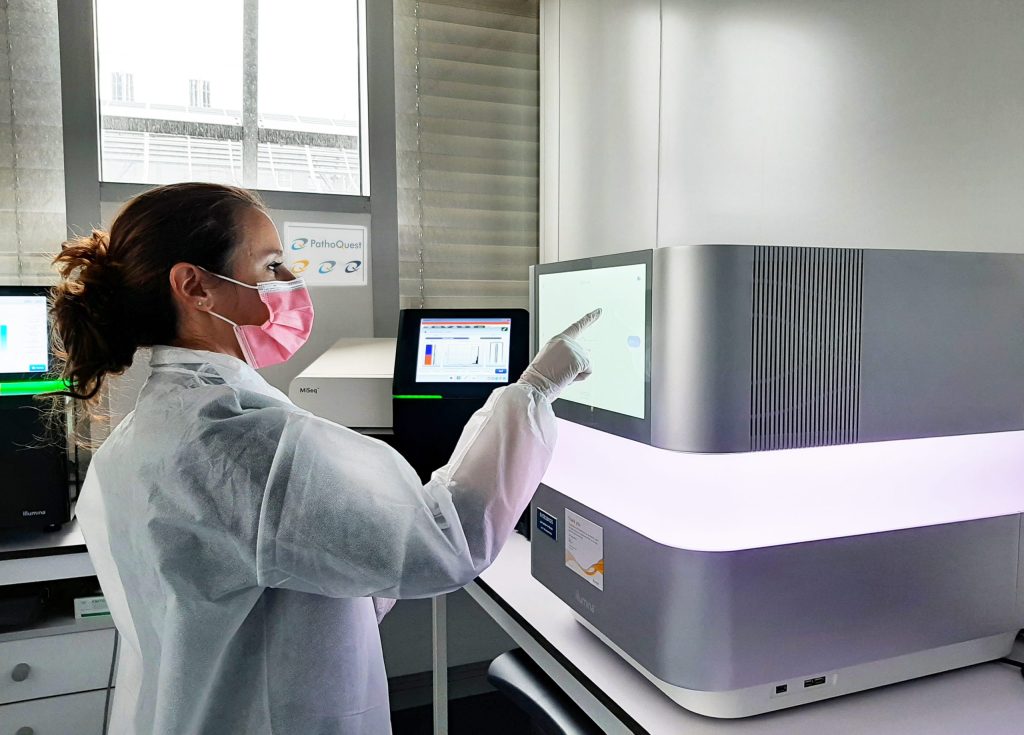

PathoQuest offers biopharmaceutical companies a game-changing genomic approach at R&D and GMP grade to ensure the biosafety of biologics like cell and gene therapy products, vaccines, and recombinant drugs. It enables a reduction in the time to market for these innovative treatments. PathoQuest’s technology combines an NGS platform with proprietary sample preparation processes followed by an automated analysis pipeline using the company’s proprietary pathogen genome sequences databases.PathoQuest entered into a strategic partnership with Charles River Laboratory (Boston, USA) in 2018.

For more information, visit www.pathoquest.com or contact us at welcome@pathoquest.com.

About SHS Gesellschaft für Beteiligungsmanagement mbH:

“Building European Healthcare Champions” is the guiding principle of the Tübingen-based sector investor SHS. With this in mind, the investor specializing in healthcare investments finances and develops its portfolio companies. Since its foundation in 1993, the focus of its investments has been on expansion financing, shareholder changes, and succession situations. In doing so, SHS takes both minority and majority stakes. Investors in SHS funds include pension funds, funds of funds, family offices, entrepreneurs, strategic investors, and the SHS management team. The equity investment of the AIFM-registered company is up to EUR 20 million. Volumes exceeding this can be realized with a network of co-investors. In its investment decisions, SHS attaches great importance to the consideration of ethical aspects. The investment company is committed to the principle of Socially Responsible Investing (SRI) and is a member of UN PRI, an investor initiative launched by the UN-Environment Programme. Its members contractually agree to comply with ecological and social guidelines in their investments. SHS portfolio companies include, for example, Phenox GmbH from Bochum, which specializes in stroke treatment, the drug delivery expert Develco Pharma AG, which is based in Switzerland and Germany, and the Dutch growth company Salvia BioElectronics B.V., which uses minimally invasive neurostimulation to treat neurological diseases. SHS is currently investing from its fifth fund, which was launched in 2018.

More information at: http://www.shs-capital.eu

Interested in receiving regular updates on SHS? Subscribe to our Newsletter, follow us on LinkedIn and check out our YouTube-channel.

About Turenne Capital Group

With more than €300 M under management, Turenne Santé supports healthcare companies in their development and transmission challenges. As an independent Private Equity player in France, the Turenne Capital group manages more than €1,4 billion. Its teams, composed of 67 professionals, including 51 investors support more than 250 companies employing 23,000 people in the health, hospitality, new technology, distribution, and innovative services sectors. To learn more about Turenne Capital, visit www.turennecapital.com

Contacts

Mélancolie Spedito-Jovial,

Marketing Manager at PathoQuest

Welcome@PathoQuest.com

Ophélie PHILIPOT

External Communications Manager

ophelie.philipot@comopi.tech

00 33 (0)6 70 07 87

Sarah Stelzer

SHS Gesellschaft für Beteiligungsmanagement mbH

Bismarckstrasse 12

72072 Tuebingen

sas@shs-capital.eu